Trust Deposit

A Trust Deposit is a stake within the a VPR network that grows automatically as participants interact with the ecosystem. Each participant maintains their own individual Trust Deposit, which reflects their activity and contribution to the trust network.

How Trust Deposits Grow

Validation Process:

When a Validation Process is executed, the Trust Deposits of both theApplicantand theValidatorincrease.Credential Issuance & Verification:

If the Ecosystem has enabled pay-per-issuance and/or pay-per-verification, the Trust Deposits of all participants involved in the Permission Tree grow each time a credential is issued or verified.

Additionally, if applicable, the Trust Deposits of the involvedUser Agent OwnerandWallet User Agent Ownerare also incremented.Service Directory Participation:

Registering or renewing a DID in the Service Directory increases the Trust Deposit of the participant who executes the transaction.

Conceptual Model

The Trust Deposit functions like a percentage-based deduction applied to circulating trust fees. These deductions accumulate in individual deposits as a reflection of ongoing participation and service provision.

For example, in the case of Verification Fees (as detailed in the Business Models section), a portion of each fee is redistributed to grow the Trust Deposits of the relevant actors in the verification process.

Each time fees are charged, an additional 20% is added and allocated to the Trust Deposit of the participant executing the transaction. This amount is also linked to the specific Permission that authorized the transaction.

When fees are distributed to other participants (e.g., Validators, Grantors, etc.), 20% of the distributed amount is redirected to their Trust Deposit, while the remaining 80% is liquid and immediately available for use.

The percentage allocated to Trust Deposits (e.g., 20%) is configurable and defined by the VPR controller.

Core Purposes

The Trust Deposit mechanism is designed to ensure that participants within an Ecosystem adhere to the rules defined in its Ecosystem Governance Framework (EGF). It serves as both an incentive and an enforcement tool within decentralized trust infrastructures.

| Purpose | Description |

|---|---|

| Incentivize Good Behavior | Participants risk losing part of their deposit if they behave dishonestly or violate governance rules. |

| Signal Serious Intent | Requires participants to have “skin in the game,” discouraging spam, fraud, and low-effort engagement. |

| Enable Slashing | Deposits can be partially or fully slashed when participants breach trust policies or contractual roles. |

| Support Decentralized Governance | Serves as the economic foundation for decentralized permission management, assignment, and revocation. |

| Ecosystem-Specific Control | Each Ecosystem can only slash the portion of a participant’s deposit that corresponds to activity within that Ecosystem. |

| Non-Custodial | Trust Deposits are held on-chain within a VPR and are not under the control of any centralized authority. |

Slash

Each Ecosystem defines, in its Ecosystem Governance Framework (EGF), the rules that participants must follow to remain in good standing. The EGF also specifies the conditions under which a slash—a penalty applied to a participant’s Trust Deposit—may occur.

When a participant is slashed:

- The corresponding portion of their Trust Deposit is forfeited, based on the severity or type of violation.

- Their ability to perform actions within the Ecosystem (e.g., issuing or verifying credentials) is suspended.

- To regain active status, the participant must replenish the slashed amount of their Trust Deposit.

This mechanism ensures accountability and alignment with the Ecosystem’s trust and governance policies.

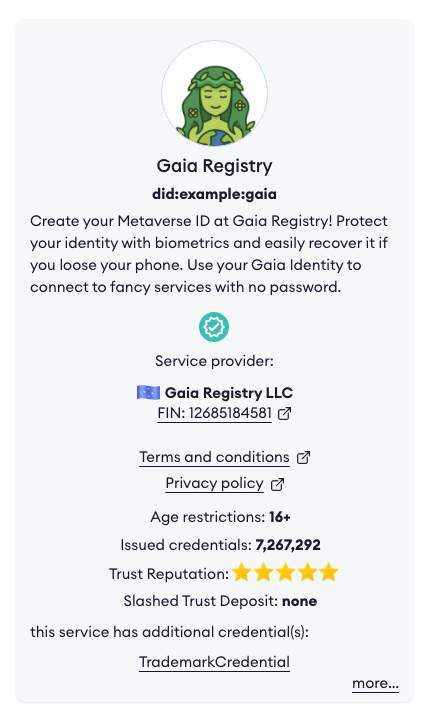

Trust Deposit-Based Reputation

Because network activity and Trust Deposit data are publicly accessible, each participant naturally builds a digital trust reputation over time. This reputation reflects both their positive contributions and any violations within the ecosystems they engage in.

Key reputation signals include:

- Growth of Trust Deposit: Active, rule-abiding participants see their Trust Deposit increase as they contribute value to the network.

- Ecosystem-Specific History: For each Ecosystem a participant is involved in, their Trust Deposit history is transparently visible to all other participants.

- Credential Activity: The number of credentials issued and/or verified by the participant within each Ecosystem is publicly observable.

- Behavioral Accountability: Any dishonest or malicious activity—especially if penalized through slashing—remains permanently associated with the participant’s account.

This transparent data can be used to compute a reputation score or star rating, enabling trust-based decisions across the network.